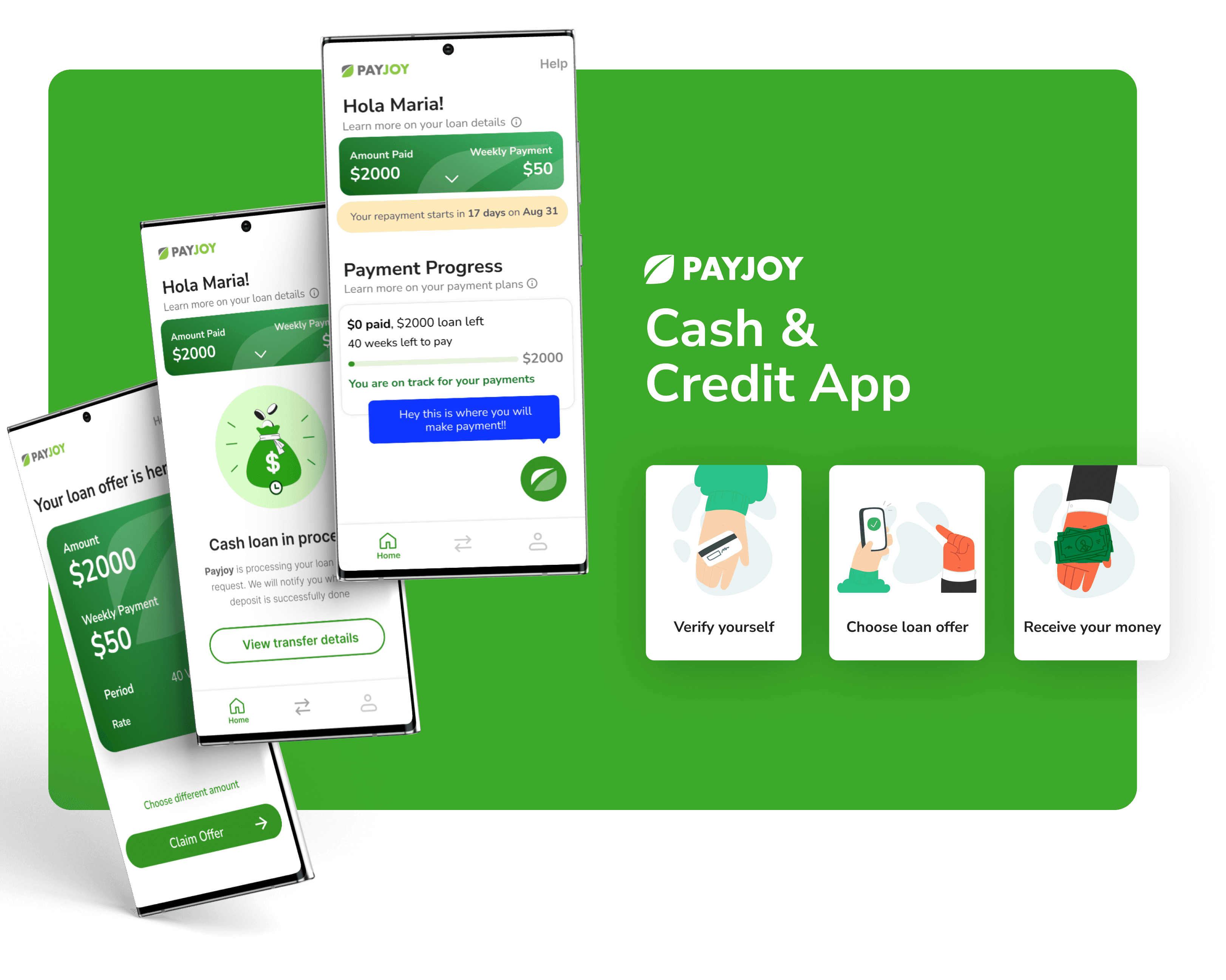

Payjoy Cash & Credit App

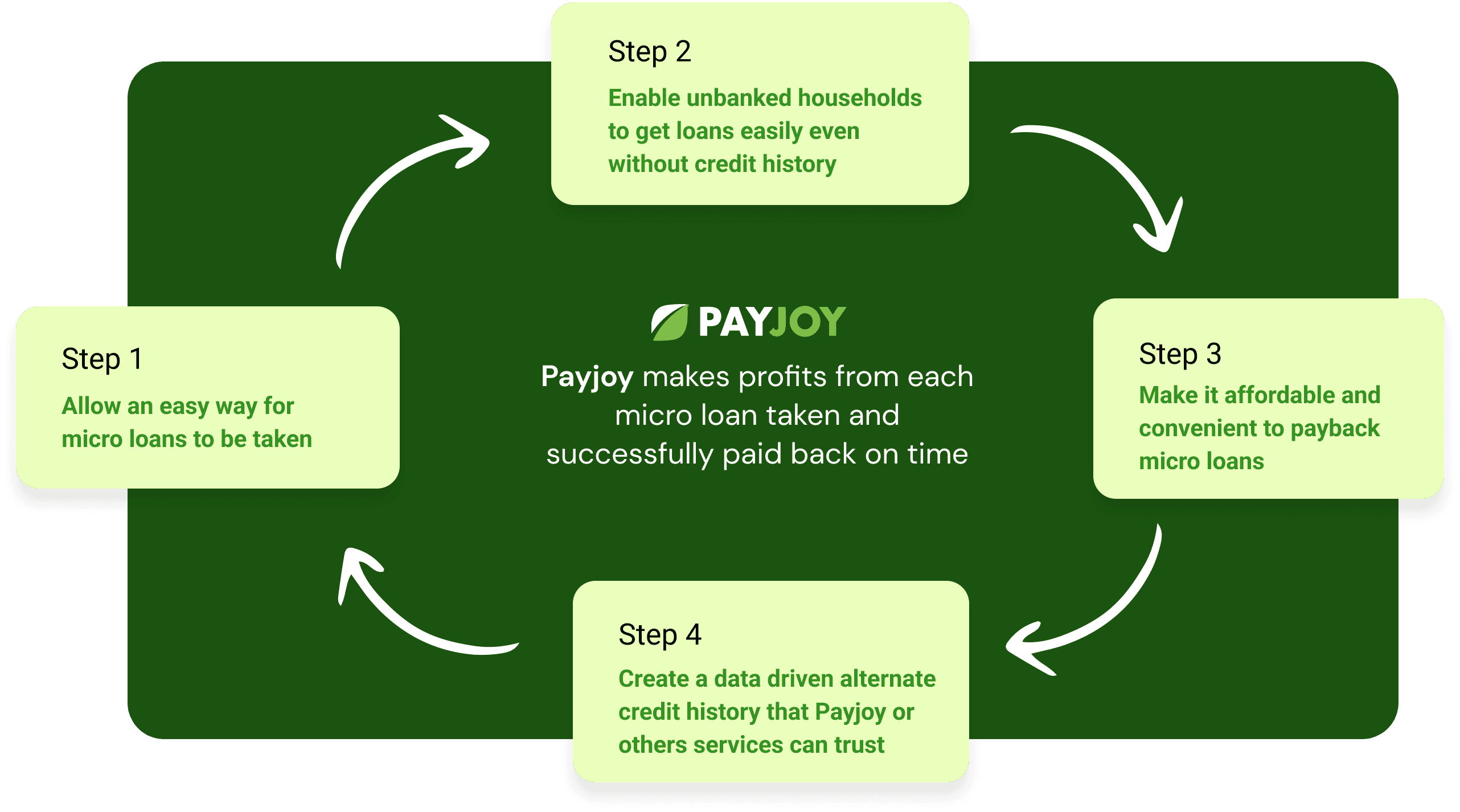

The best way for underbanked/unbanked households to have access to cash loans with low interest rates and flexible payment options with you when you need it. Making it easy, fast and affordable to have cash at your disposal, without so much paperwork.

Context

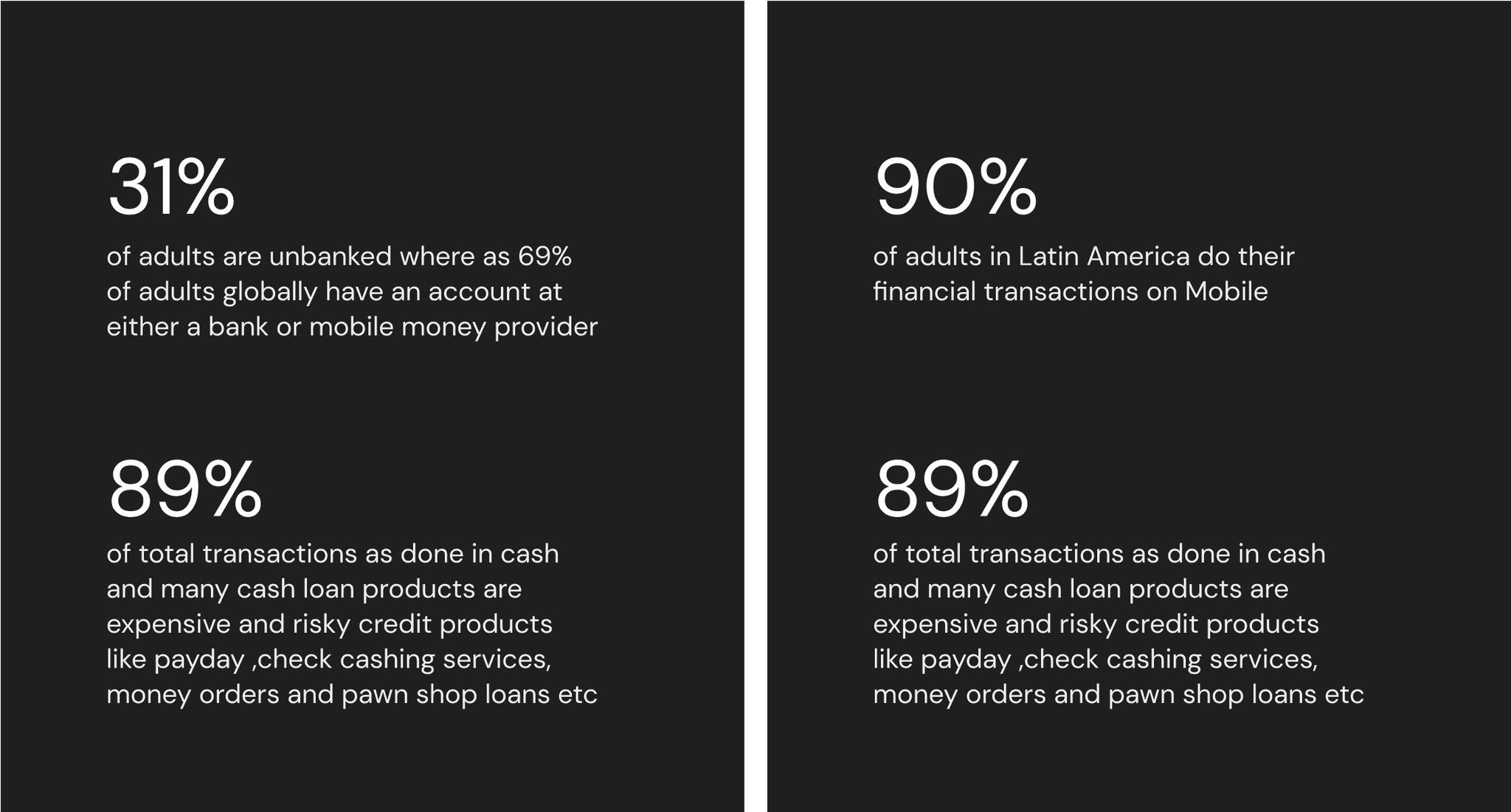

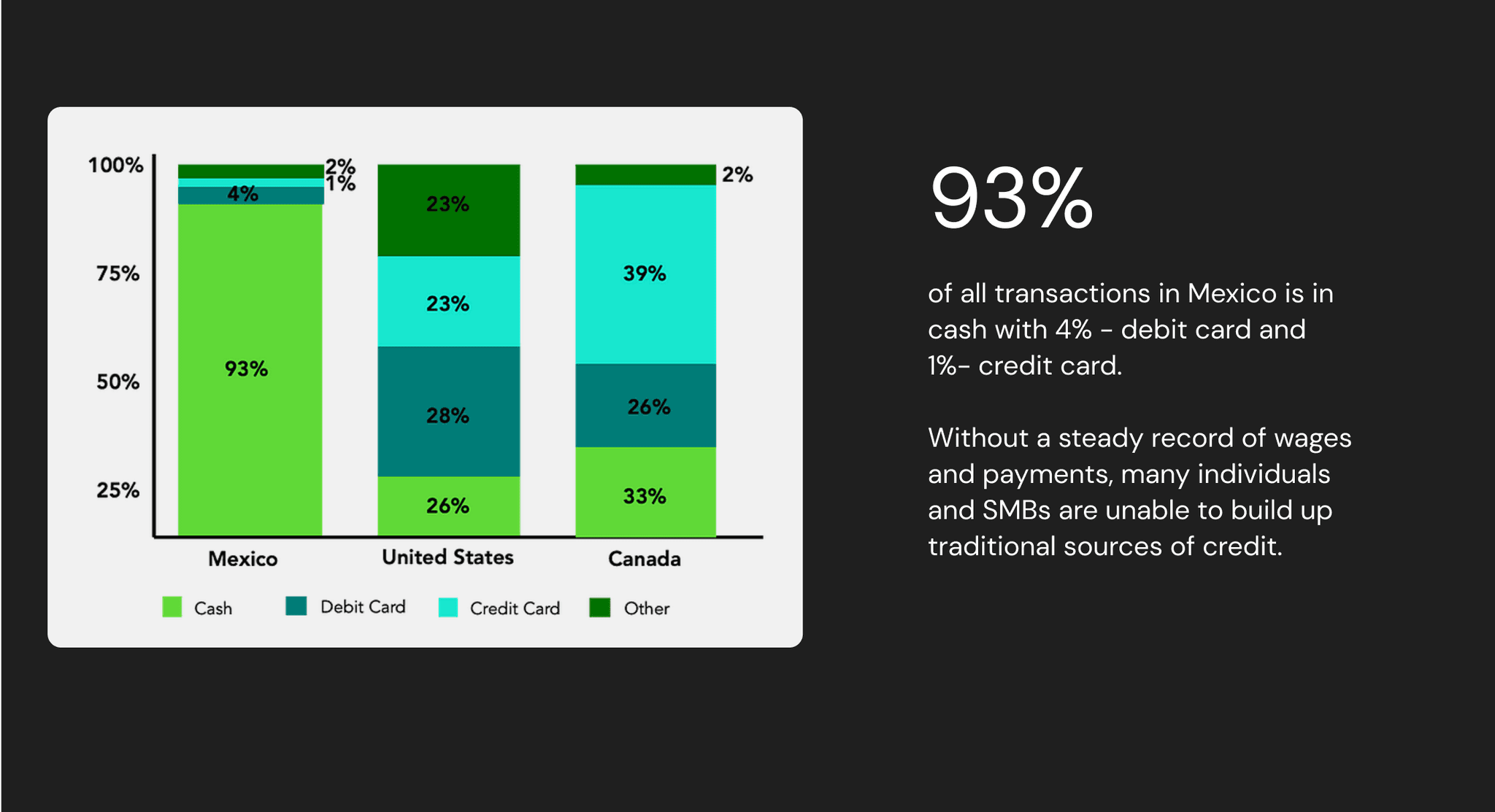

An “underbanked” household is one that has a bank account but lacks adequate access to other traditional financial services, such as credit and loans.

They seek expensive and risky cash/credit alternative financing services outside of their bank like rent-to-own, payday and auto title loans ,check cashing services, money orders and pawn shop loans etc.

Mexico has the 7th largest underbanked market in the world and the largest in Latin America with 30% of Mexico's population lacking formal banking products.

Problem

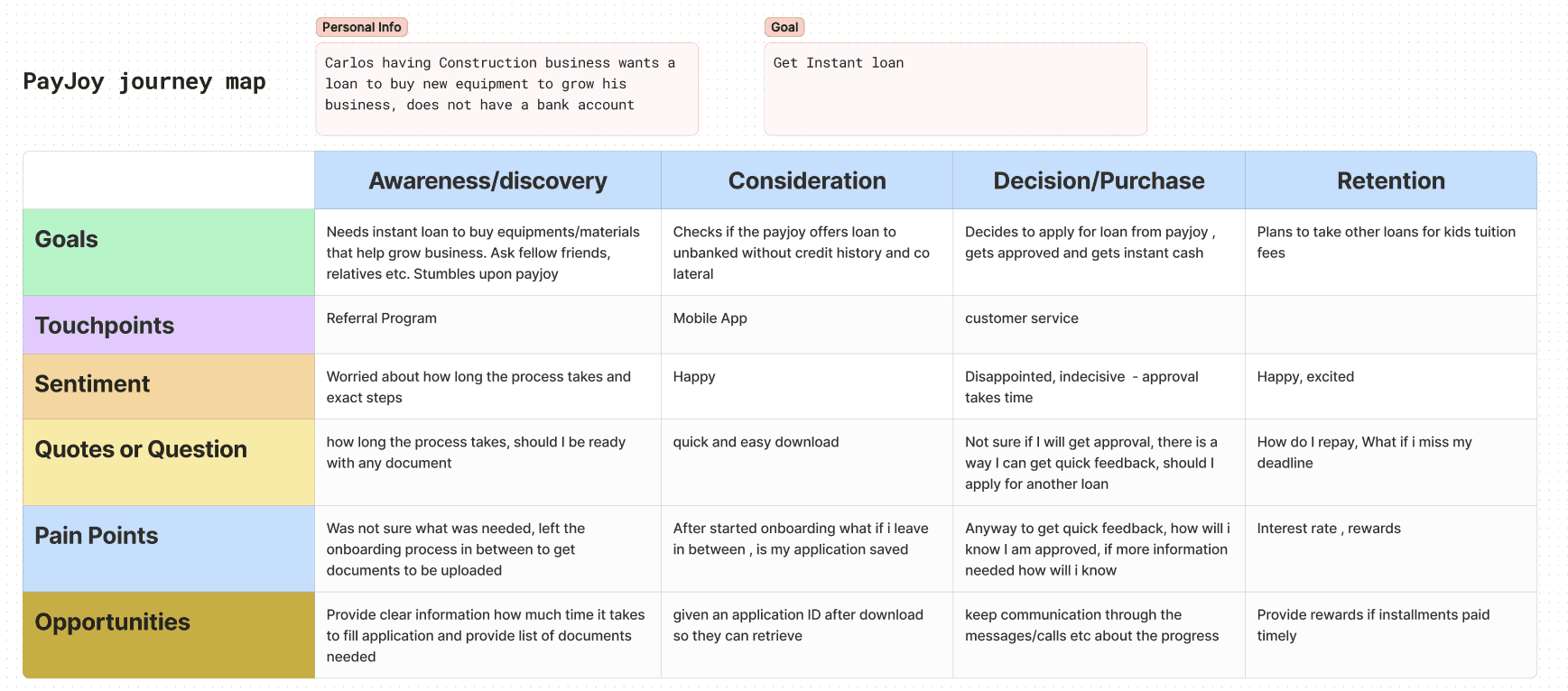

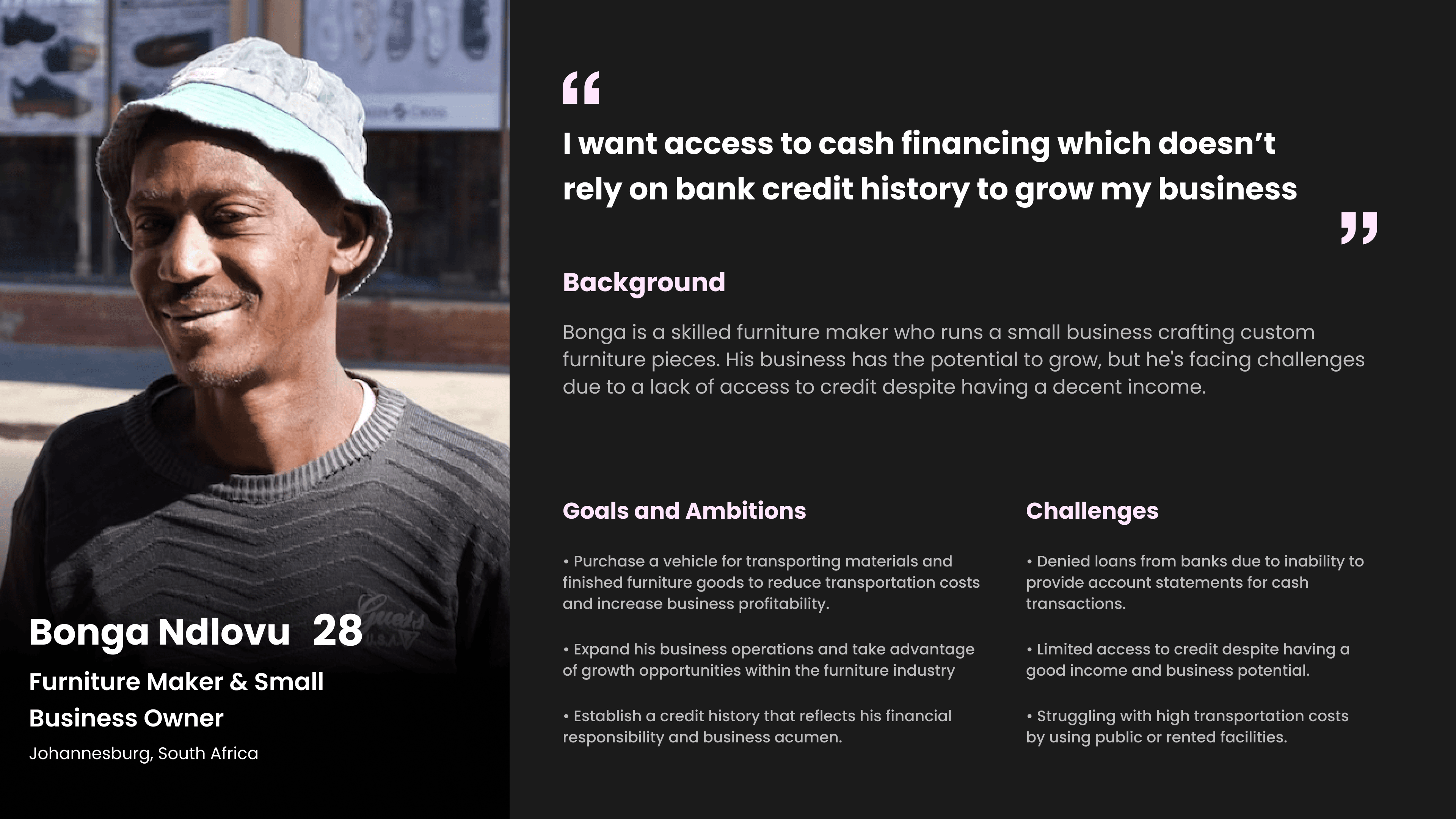

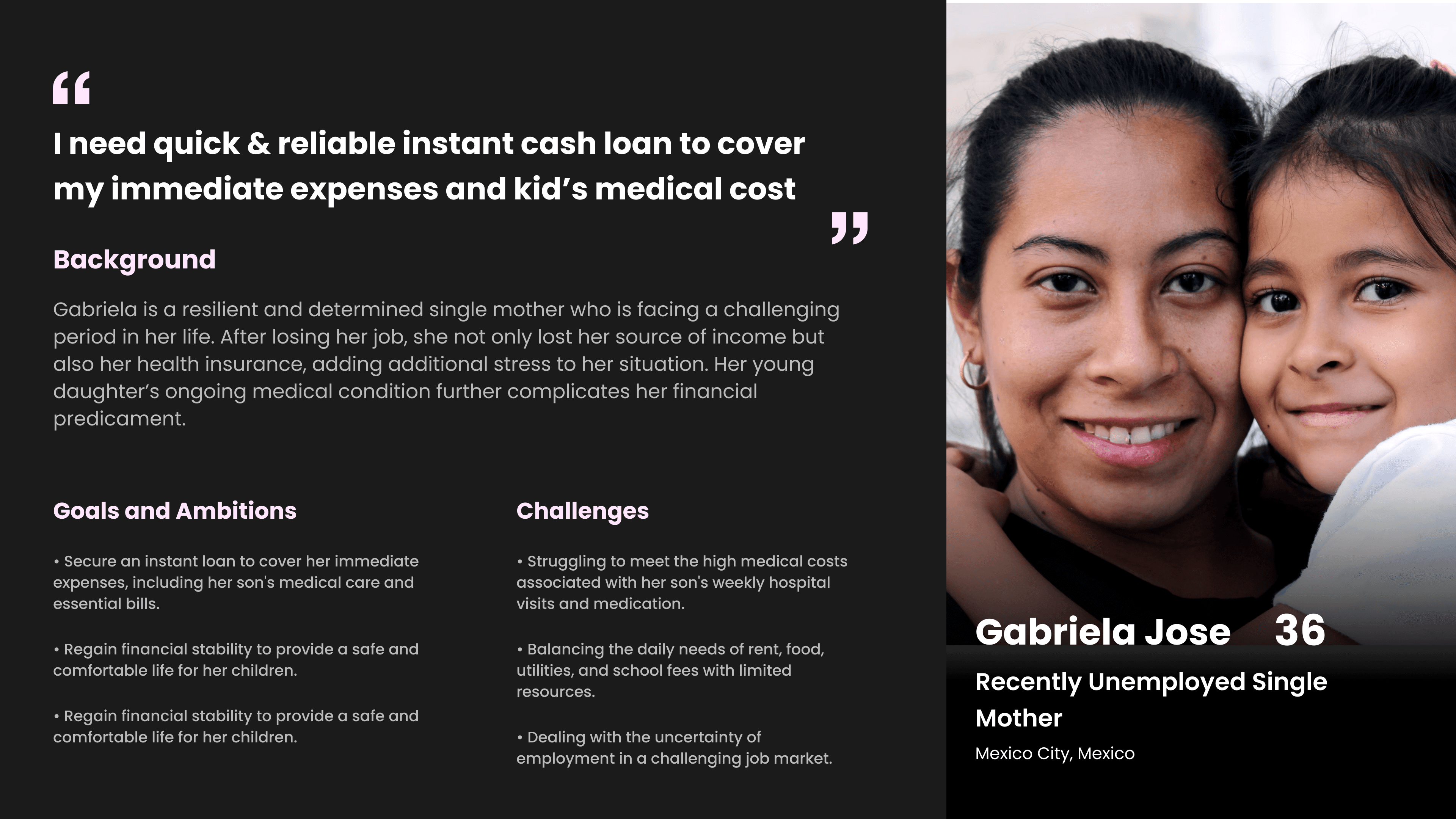

Many households in Latin America, South Asia and Africa who are underbanked (eg: lower-income households, less-educated households, etc) find it difficult to have convenient access to cash loans at affordable rates without any credit history, leading to time-consuming, complex and costly loan terms.

Solution

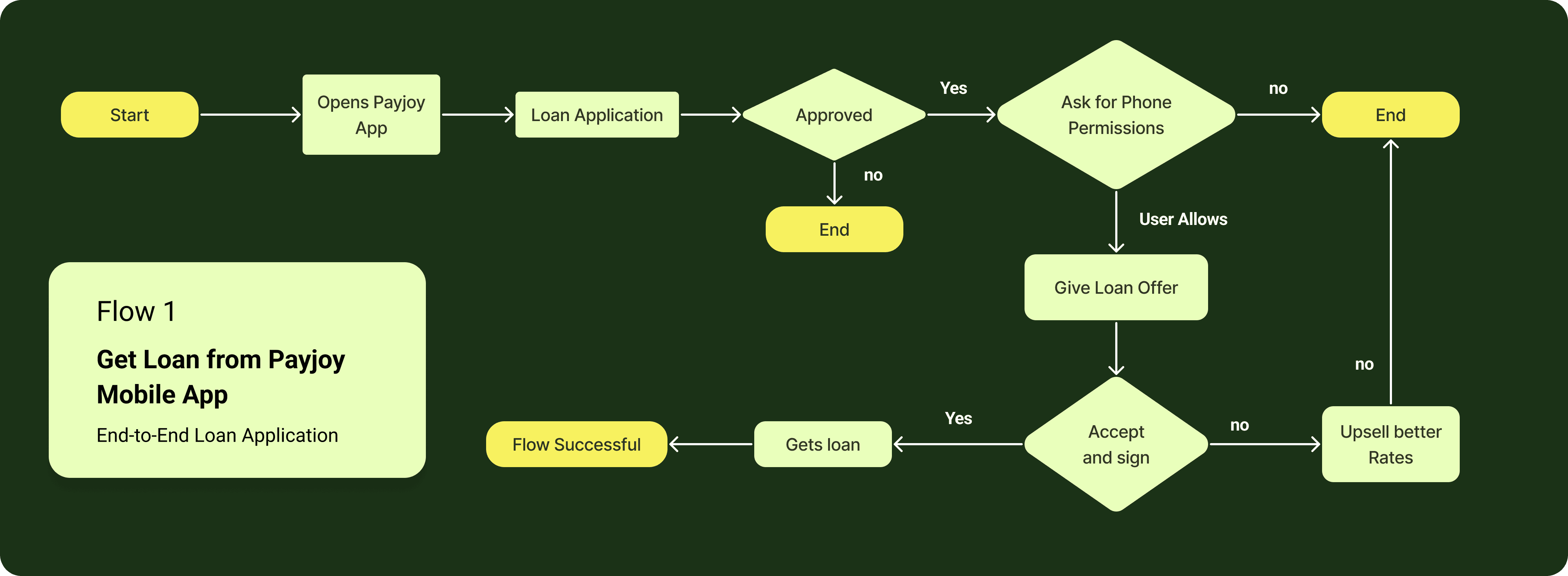

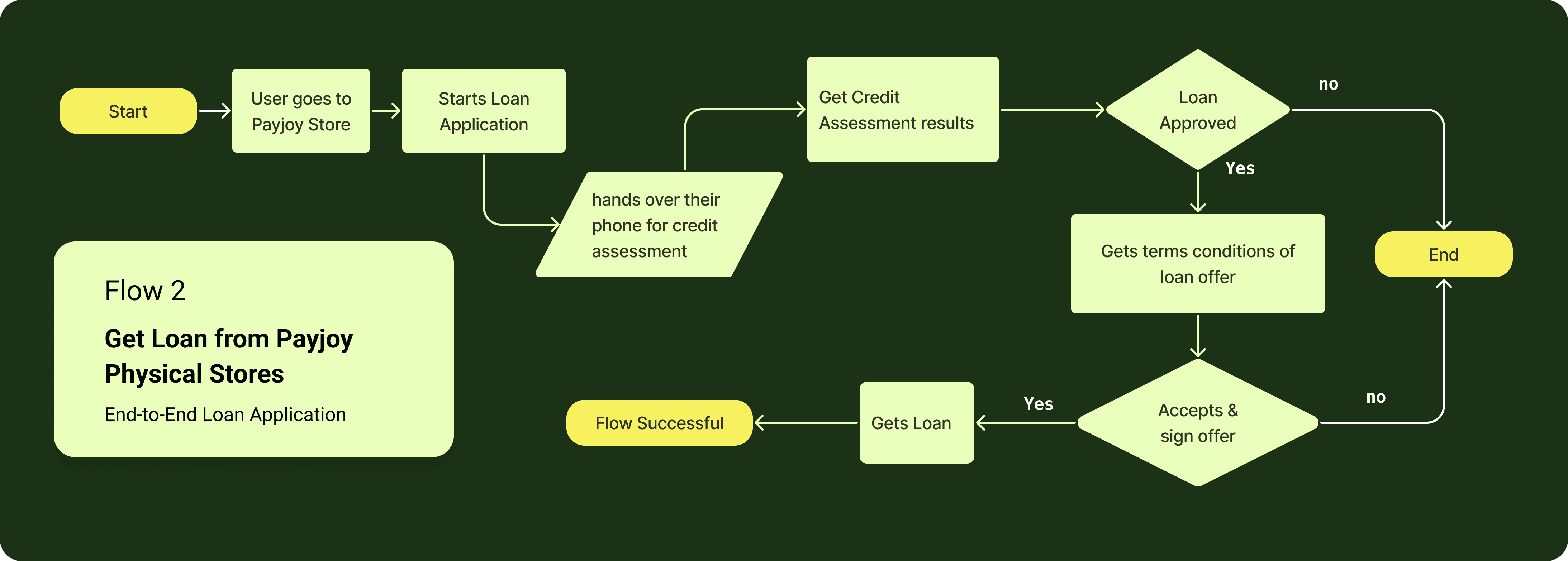

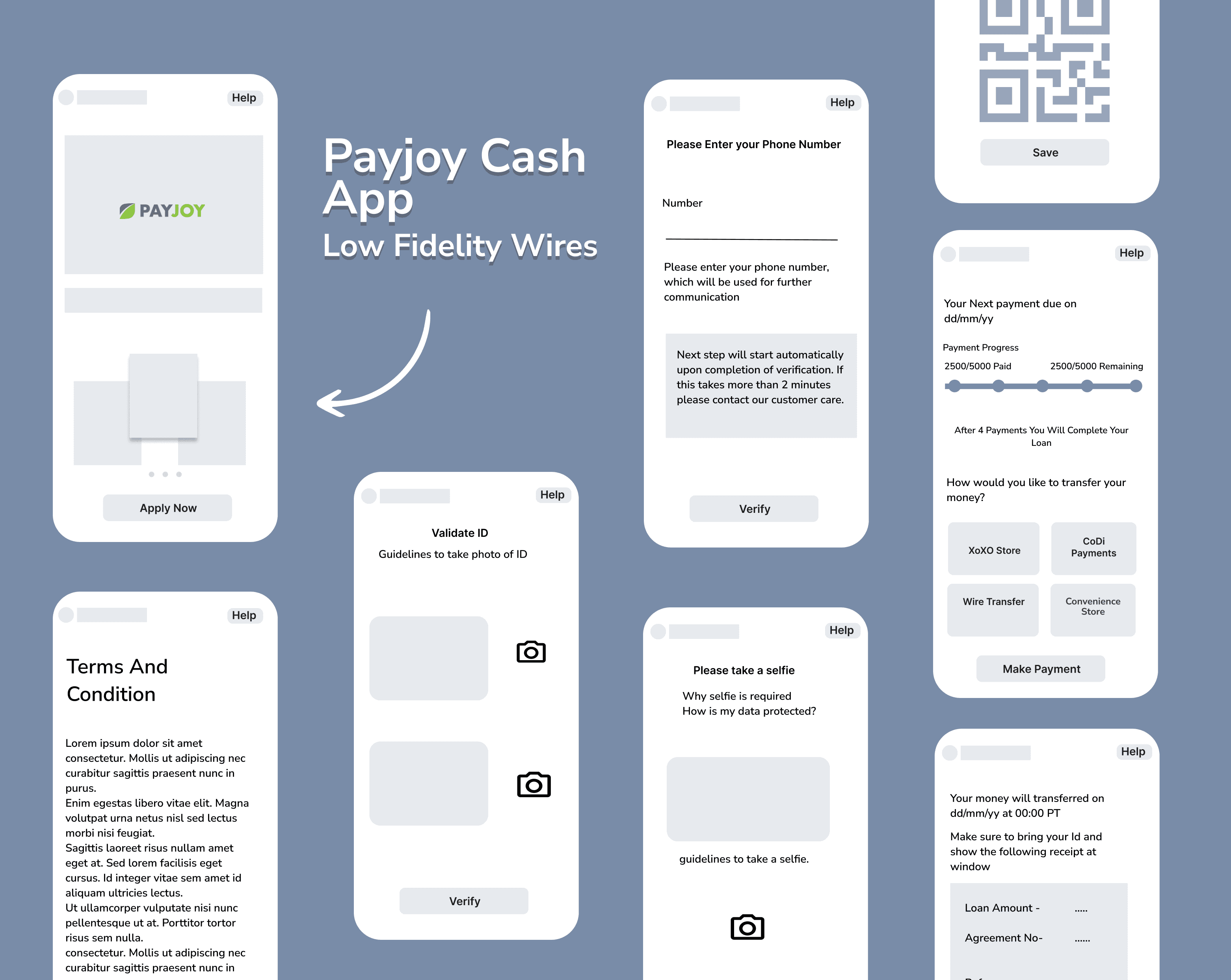

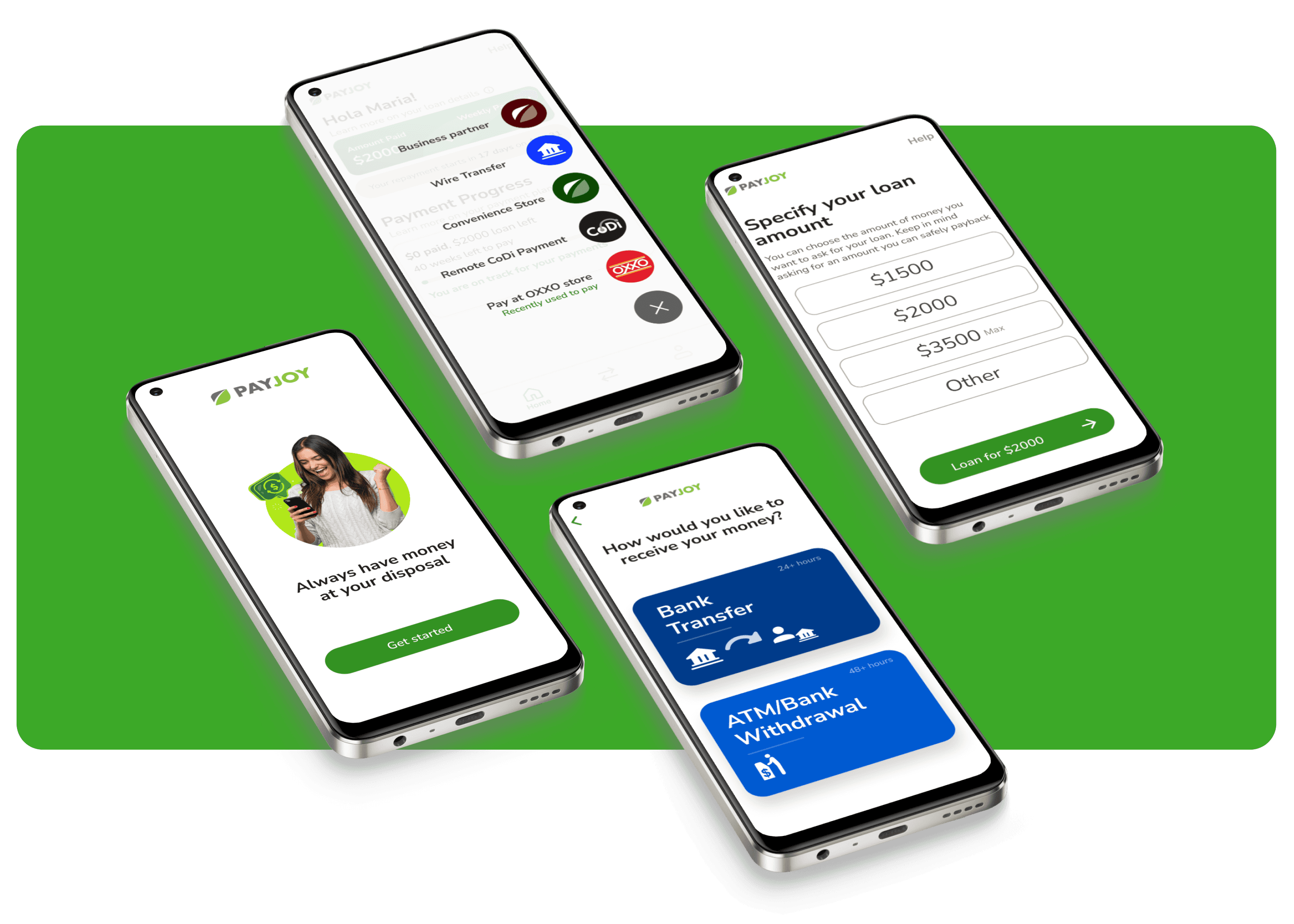

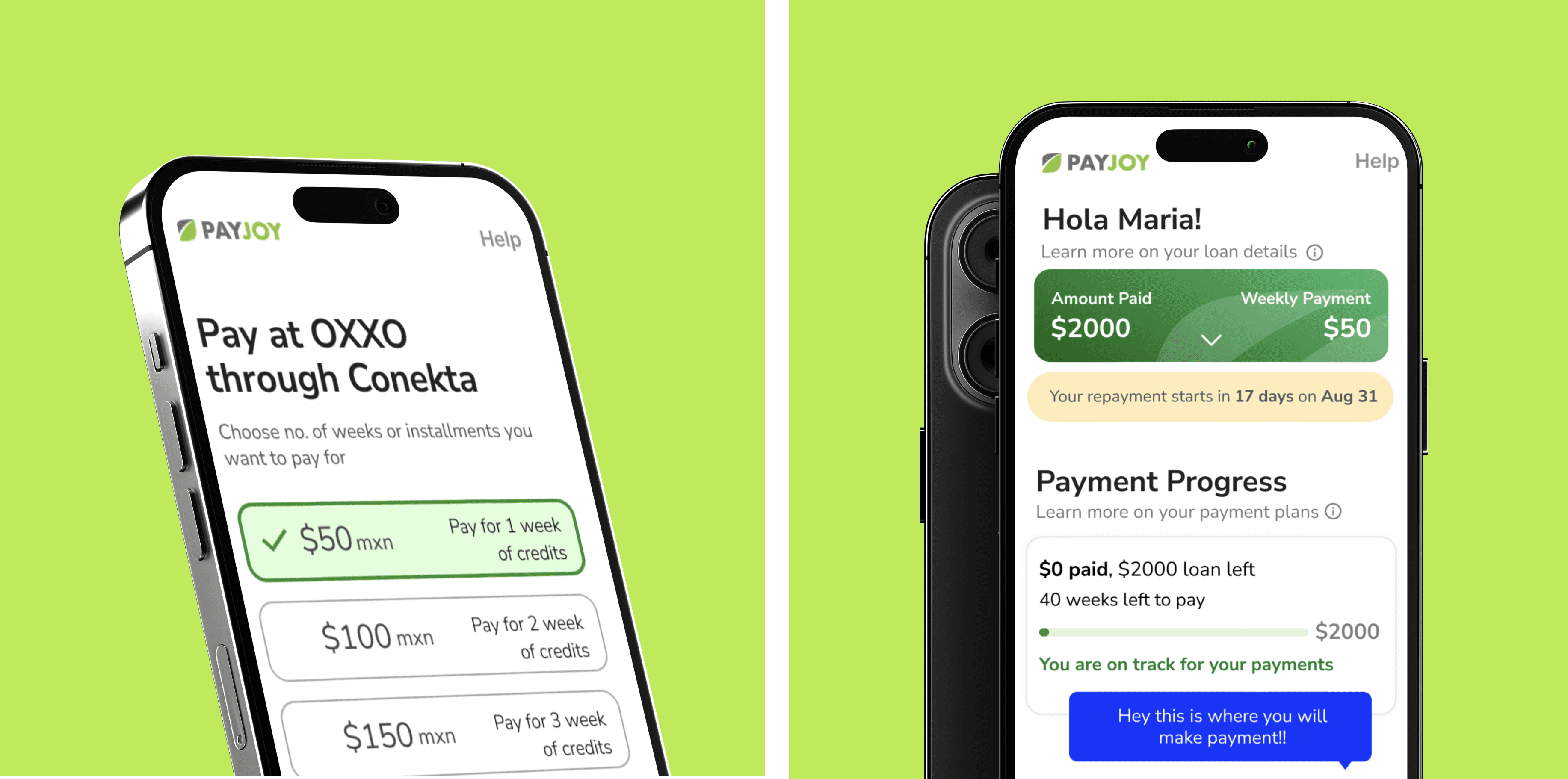

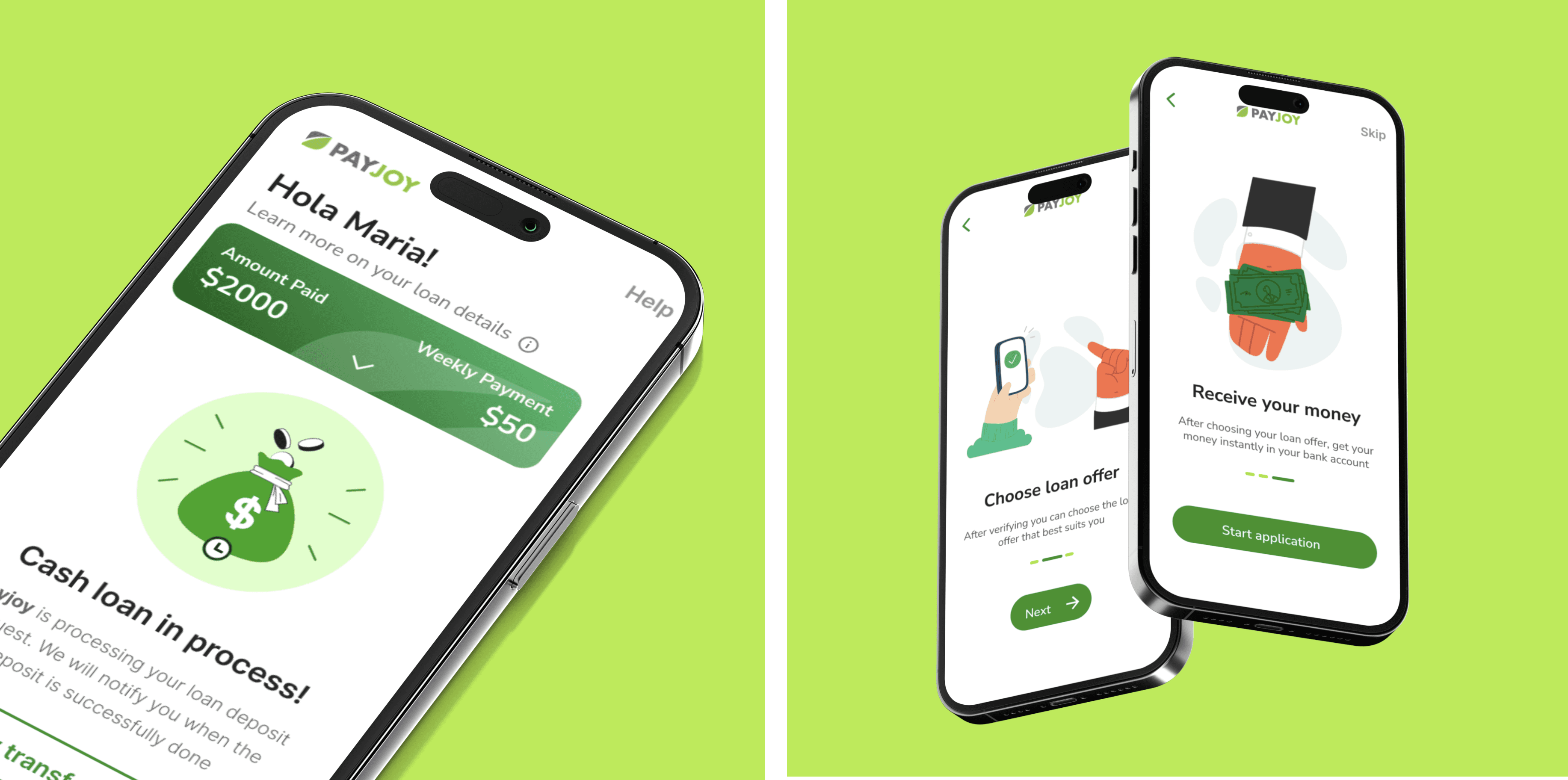

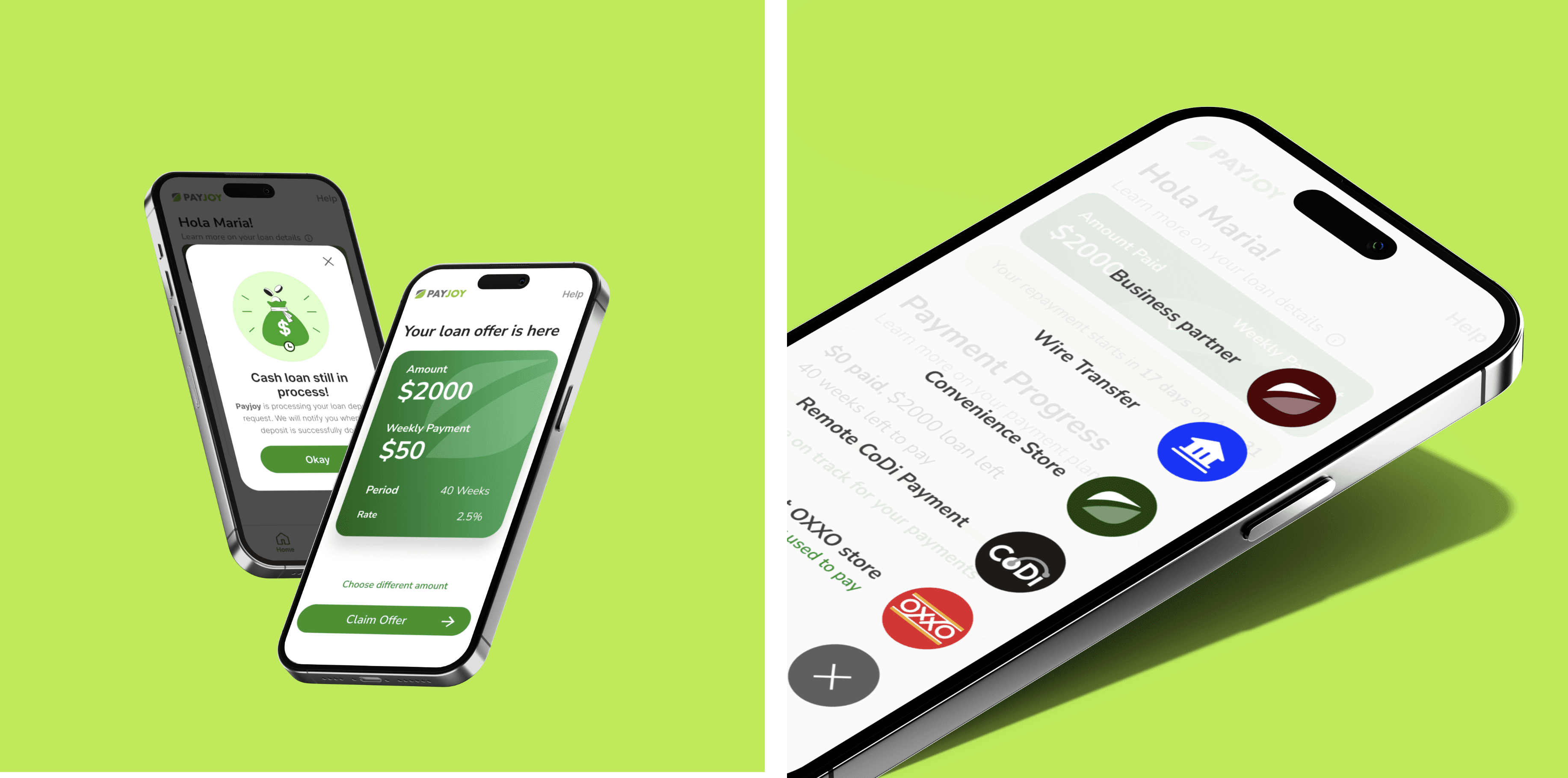

Payjoy Cash App makes it easy to get instant cash loans at affordable interest rates with easy money withdrawals and flexible repayment methods all from the convenience of a single mobile app.

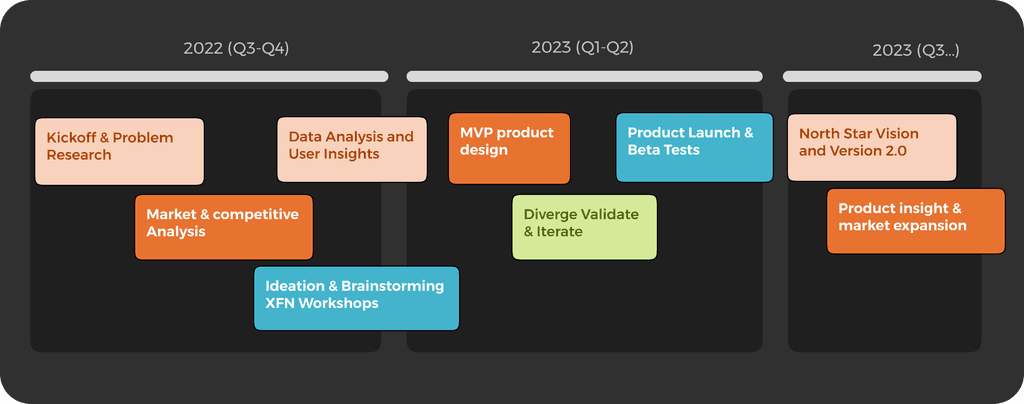

Defining the product strategy

User success stories

"My husband and I wanted to start a business for a long time, but we didn't have enough capital. With PayJoy Credit Line we can fulfill our dream" - Marella, 32

"PayJoy Cash has been an godsend to keep my auto accessories business growing. It offers convenient and accessible payment options, but above all, the process is very fast" - Hector, 52

My Reflections